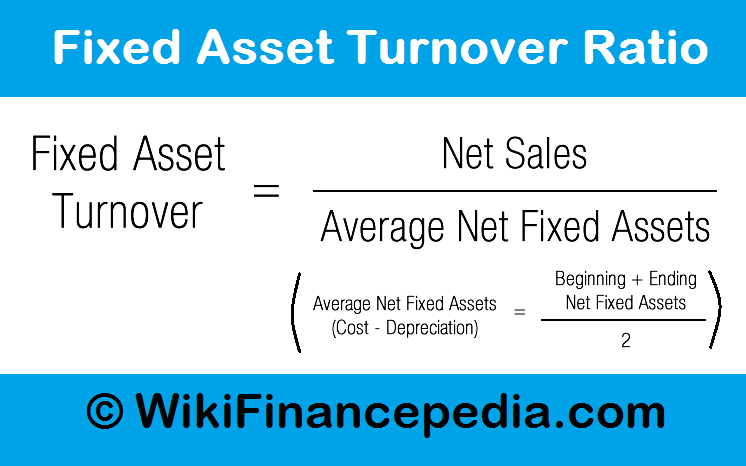

In case you want to calculate the fixed asset turnover ratio by average fixed assets, its can be calculated by dividing the sum of beginning and ending fixed assets by 2. The calculation of fixed asset turnover can be calculated as net sales divided by average property, plant, and equipment as the following formula.įixed asset turnover ratio = Net sales ÷ Net fixed assetsįixed asset turnover ratio = Net sales ÷ Average fixed aseets

ABC Corporation reported net sales of 1,000,000 for the year, and its average total assets amounted to 500,000. Once the business hits the maximum capacity, this means the business cannot increase their production (and their sales) anymore. Sample Calculation To illustrate how the asset turnover ratio is calculated, let’s consider a hypothetical company, ABC Corporation, for the fiscal year ending Dec. However, if the fixed asset turnover ratio is too high (I mean extremely high), the business may be close to the maximum capacity. In contrast, the lower levels of fixed asset turnover ratio indicate that the business cannot (or just not) using their fixed asset efficiently to generate their sales, this might also indicate bad business management. Normally, the higher fixed asset turnover ratio, the more efficiently the business management their fixed asset. Total Sales 7,00000 Sale Return 1,00000 Fixed Assets at Cost 3,00000 Accumulated depreciation till. The ratio is a summarize the efficiency in a business using their fixed asset. Fixed Asset Turnover Ratio and (b) Gross Profit Ratio Rs.

Fixed asset turnover ratio = Net sales ÷ Net fixed assets.The fixed asset turnover ratio is also known as the PP&E turnover ratio (PP&E stands for property, plant, and equipment). The fixed asset turnover ratio is a comparison between net sales and net fixed assets which includes: property, plant, and equipment. The fixed asset turnover ratio will show the number of dollars in sales that the business generated for each dollar of fixed assets. Fixed asset turnover ratio is an asset management tool to evaluate the appropriateness of the level of a company’s property, plant and equipment.

0 kommentar(er)

0 kommentar(er)